The 10-Second Trick For Offshore Trust Services

Table of ContentsGet This Report on Offshore Trust ServicesOffshore Trust Services for BeginnersThe Only Guide to Offshore Trust ServicesOffshore Trust Services for Dummies

We at Service Setup Worldwide can lead you with all this. If you could want our skilled advise on how an offshore trust fund can match your holistic offshore plan as well as could desire professional help in picking a territory and also trust company that finest matches your necessities, don't wait to call us, we would certainly enjoy to assist.Wyoming continually places amongst one of the most recommended states in the nation in which to develop an Exclusive Trust Company. In the last decade, as family members and riches administration specialists have actually started to concentrate on the significance of choosing a territory with a desirable trust climate, Wyoming's appeal as depend on situs has actually seen impressive development.

When it comes to Personal Depend on Business, there isn't a one-size-fits-all design. Wyoming is among just a couple of top-ranking states that permits the development of managed along with uncontrolled Exclusive Trust fund Firms. This offers us, at Frontier Administrative Solutions, the largest of latitudes when it pertains to helping a family pick and also develop the most proper sort of Private Count on Company.

Wyoming has enacted a 1,000 year restriction on multigenerational counts on. Wyoming Permits Both Regulated and also Unregulated Private Trust Fund Business: Wyoming is one of just a few top-rated trust fund situs states that enable for the formation of unregulated as well as controlled private count on firms, both of which provide a high degree of security and also personal privacy.

Offshore Trust Services Things To Know Before You Get This

A lot of households developing Personal Count on Companies in Wyoming select the unregulated variation since they are cost reliable, simple to establish up and also provide, need little year-to-year coverage, and also give the best versatility in terms of family control as well as structure. That said, there are circumstances that ask for the regulated option.

With the adoption of the Attire Trust Fund Code (UTC), Wyoming and a handful of other states permit a trustee or recipient to customize a depend on with or without a court order - offshore trust services. Online Rep Statutes: These laws clarify depend on management problems when there are contingent, coming, on unascertainable beneficiaries. Property Defense Legislation: Under Wyoming regulation, Frontier Administrative Solutions has the ability to structure depends on as well as Exclusive Count on Firms to make sure that the possessions they hold are substantially shielded from the reach of creditors.

Such counts on are a type of spendthrift trust created by settlors for their own advantage to provide property security in addition to attain other estate preparation goals. Optional Depends on: Wyoming statutes like this provide clear definitional assistance regarding discretionary counts on and, missing an abuse of discretion, protect against creditors from engaging discretionary distributions.

A Biased View of Offshore Trust Services

This indicates the debtor's ballot rights are not affected, as well as as a result, the lender has no chance to require a distribution. As long as the client can out-last the lender, it is likely the creditor will certainly resolve for less. Wyoming has sole solution billing order protection for LLCs and FLPs, plus extra possession defense functions for FLPs.

Mark Davies is a leading authority on the tax advantages of establishing overseas depend on frameworks with over two decades' experience both onshore as well as offshore. Trust funds are an old construct of English legislation where the legal possession and beneficial or fair possession of an asset or possessions is split as well as held by various people.

A settlor will usually sign a "depend on action" or "trust fund instrument". A revocable trust is where the settlor may require the trustees to return the trust fund properties to him or her on demand.

Getting The Offshore Trust Services To Work

An offshore trust fund will certainly pay zero taxes in the tax view sanctuaries where trust development happened, offshore trusts are not permitted to possess assets in the tax haven where they are registered and also the trust pay no tax obligations on butts owned abroad. Offshore trust funds pay no inheritance tax, funding gains tax, stamp responsibility and transfer fees, however a count on should pay an annual upkeep charge and a registration charge.

Offshore trust fund accounts can be established at offshore banks in support of offshore counts on. Offshore trusts are not allowed to bring out any sort of business activity according to offshore trust fund regulation however can participate in the sale and acquisition of shares as well as supply as long as these activities are to the advantage of the beneficiaries of the overseas count on.

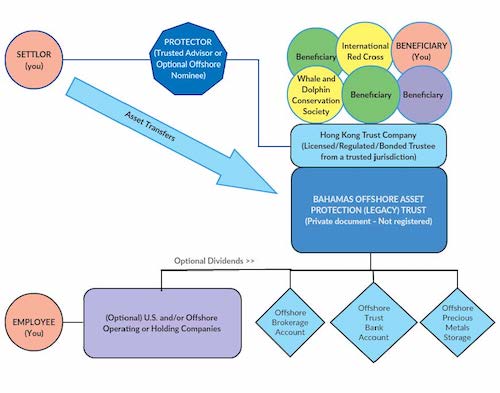

The settlor of an overseas count on can additionally be named as a beneficiary of that count on. The Trustee manages the trust according to the terms as well as conditions set out in a Trust fund Act.

Offshore count on the tax sanctuaries are an exceptional for overseas investing and supply fantastic advantages.